What Percent of Health Insurance Are Employers Required to Pay

What per centum of health insurance is paid past employers?

When yous're considering a new health insurance program, your organization's contribution strategy is an of import decision. In elementary terms, how much volition employees pitch in for coverage, and what percentage will exist paid by the employer? With traditional group health insurance plans, the system must contribute a minimum percentage, leaving the employees to pay the remaining corporeality, normally through a payroll deduction. And then only what percent do employers typically pay in the United states? Across the country, a Kaiser Family Foundation survey constitute that the average percent of wellness insurance paid by employers is 83% for single coverage and 73% for family coverage. Let'due south dive into these stats a lilliputian deeper. Notice out the average cost of health insurance in your area in our state-past-country guide In 2020, the standard company-provided health insurance policy totaled $7,470 a yr for single coverage. On average, employers paid 83% of the premium, or $half-dozen,200 a year. Employees paid the remaining 17%, or $1,270 a year. For family coverage, the standard insurance policy totaled $21,342 a year with employers contributing, on average, 73%, or $15,579. Employees paid the remaining 27% or $5,763 a yr. While large employers contribute a significant corporeality to employees' healthcare, small employers tell a different side of the story. 27% of covered workers in small firms are in a plan where the employer pays the unabridged premium for single coverage, compared to only 4% of covered workers in big firms. Similarly, 28% of covered workers are in a program where they must contribute more than one-half of the premium for family coverage, compared to 4% of covered workers in large firms. A probable reason for this is that small businesses simply can't afford to brand the kind of contributions larger employers can. After all, even a 50% contribution may be more than what's available in a small employer'southward benefits budget. Considering that only 48% of firms with iii to nine workers offering coverage compared to virtually all firms with 1,000 or more than workers that offer coverage, minor employers may too feel that they don't accept enough employees to make investing in wellness benefits worth information technology at all. in order to offering a health do good at all. Not simply do small employers have tighter budgets to brainstorm with, the rise toll of health insurance makes information technology even harder to offering a do good. The boilerplate premium for family unit coverage has increased 22% over the last 5 years and 55% over the concluding ten years, significantly more than than either workers' wages or aggrandizement. This steady increase in costs tin can brand it hard for pocket-sized employers with tight budgets to keep to offer employees with a health do good that will provide enough value. As many pocket-size employers tend to struggle with meeting minimum health insurance contribution requirements, alternative contribution strategies and arrangements prove to be helpful. For example, instead of paying for a company-provided health insurance policy, many small employers are providing a health reimbursement organisation (HRA)—an arrangement in which employers give employees an assart toward their individually-purchased health insurance premiums. Because these arrangements allow employers to personally define their contribution, small-scale organizations often find them to exist the more affordable option. The reimbursement process for employers and employees include the post-obit steps: There are two great options for employers who determine they can't afford traditional group health coverage for all of their employees. A qualified pocket-size employer HRA (QSEHRA) is a health benefit for employers with fewer than 50 full-time equivalent employees who don't want to offer employees group health insurance. With a QSEHRA, employers reimburse employees tax-free for their medical expenses, including individual health insurance premiums up to a maximum contribution limit. Check out our latest QSEHRA almanac report to see how a QSEHRA helped our customers last year. Download our beginner's guide to QSEHRA The individual coverage HRA (ICHRA) is a wellness do good for employers of all sizes. With an ICHRA, small organizations tin reimburse employees tax-gratuitous for private wellness insurance premiums and other medical expenses. Information technology can function as a stand-solitary benefit or as a separate option in an organization'due south health benefits program, aslope group health insurance. In that location are no limits for company size and no restrictions for allowance amounts. Download our beginner'southward guide to ICHRA When looking at what percent of health insurance is paid by employers, nosotros see that there are differences betwixt modest and large employers. While most big employers offer some kind of traditional group health insurance and cover the majority of their employees' premiums, modest businesses are less probable to be able to select traditional health insurance due to cost, less market options, size, and low flexibility. Because of this, many small employers are taking a second look at private wellness insurance paired with budget-friendly health reimbursement arrangements, such every bit an ICHRA or QSEHRA, that will let them to cull an allowance that will piece of work for them and their employees. To find out how an HRA will work for you and your business concern needs, schedule a call with a personalized benefits advisor at PeopleKeep for help getting started. This article was originally published on Baronial 12, 2020. It was final updated on September 24, 2021. Employers pay 83% of wellness insurance for single coverage

Modest employers contribute significantly less to family unit coverage

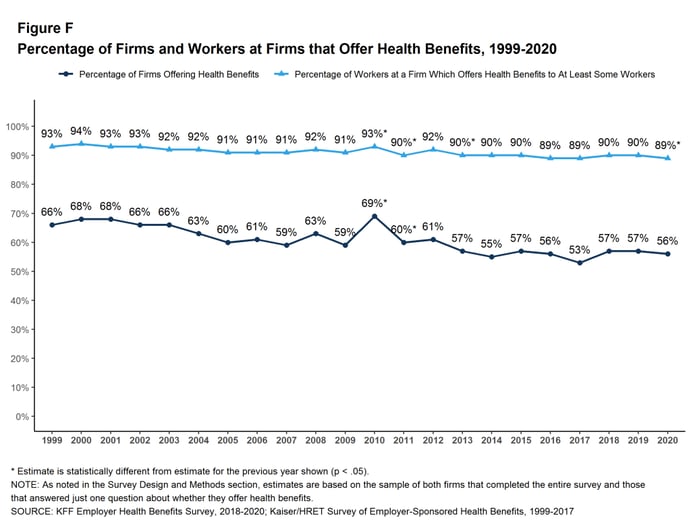

Percentage of firms offering health benefits

Culling contribution strategies

How HRAs piece of work

Qualified small-scale employer HRA (QSEHRA)

Individual coverage HRA (ICHRA)

Conclusion

Topics: Group Health Insurance, Kaiser Family unit Foundation, Premiums, Small Grouping Health Insurance, Qualified Small Employer HRA, Healthcare Costs, Individual Coverage HRA

Source: https://www.peoplekeep.com/blog/what-percent-of-health-insurance-is-paid-by-employers

0 Response to "What Percent of Health Insurance Are Employers Required to Pay"

Post a Comment